19 January 2015

‘The End of the Last Great Bull Market?’

As we start the New Year the talk is of bear markets (falling prices) in oil and whether the bull market (rising prices) in bonds is over or will continue. Actually knowing whether a market is in bull or bear phase can itself be tricky, with differences of opinion sometimes lasting years.

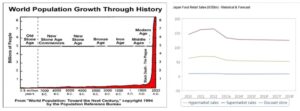

Rather than get into the detail of what defines a bull or bear market let’s look at an obvious bull market, few would deny – the human population – surely one of the longest “bull” runs in history. But could that run be coming to an end? While Japan is perhaps the best known example of a falling population, Russia is not far behind. Russia included, the total population of the continent of Europe peaked around the year 2000 and has fallen since 2004!

Not a bad thing you may say, after all the global population is set to rise by 1.5bn between 2005 and 2020. That’s the same number as were actually alive in 1950! Arguably part of the reason Japan continues on its merry path is that most of the population would prefer a bit more space and a bit less hassle. But will it be a good thing for your assets…..perhaps not if you think about the second chart!

Profits have, on the whole, at least something to do with the number of people around. Tesco’s profits have been bad enough, imagine what they would be like if the UK’s population was falling too? The second chart suggests Japan’s food sales aren’t going anywhere fast!

Also studies suggest a link between rising stock markets and demographic growth. The 1980s and 90s were boom years for stock-market investors, with globalisation, deregulation and rising productivity driving double-digit returns. This coincided with the post-war baby boom resulting in a huge bulge in the numbers of people entering working-age whilst an increase in life expectancy forced people to think about saving more. The core savings group, (those with excess income to save) soared.

So what can we do about it? Stop worrying about global fish stocks, carbon emissions and traffic jams? Perhaps, although the speed of change will be slow and the population peak still a decade or three away. So the impact on your assets from changing demographics may be pretty imperceptible too. However, it does suggest there is more than the stars aligning against the stock markets for massive returns in the future. That and buying markets as a whole, “indexing”, which grew so popular in the 80s and 90s precisely because markets were going up all the time, may not be the way to invest going forward.

As global population growth slows, and possibly declines in many parts, the risk in the future may be with the conventional “indexing” of your investments. So there may be some method in our madness of just investing in stocks that we think have strong fundamentals even if the performance doesn’t track everyone else in the short term. After all running with the herd won’t be much fun if the herd starts on a 500 year downslope….