16 July 2025

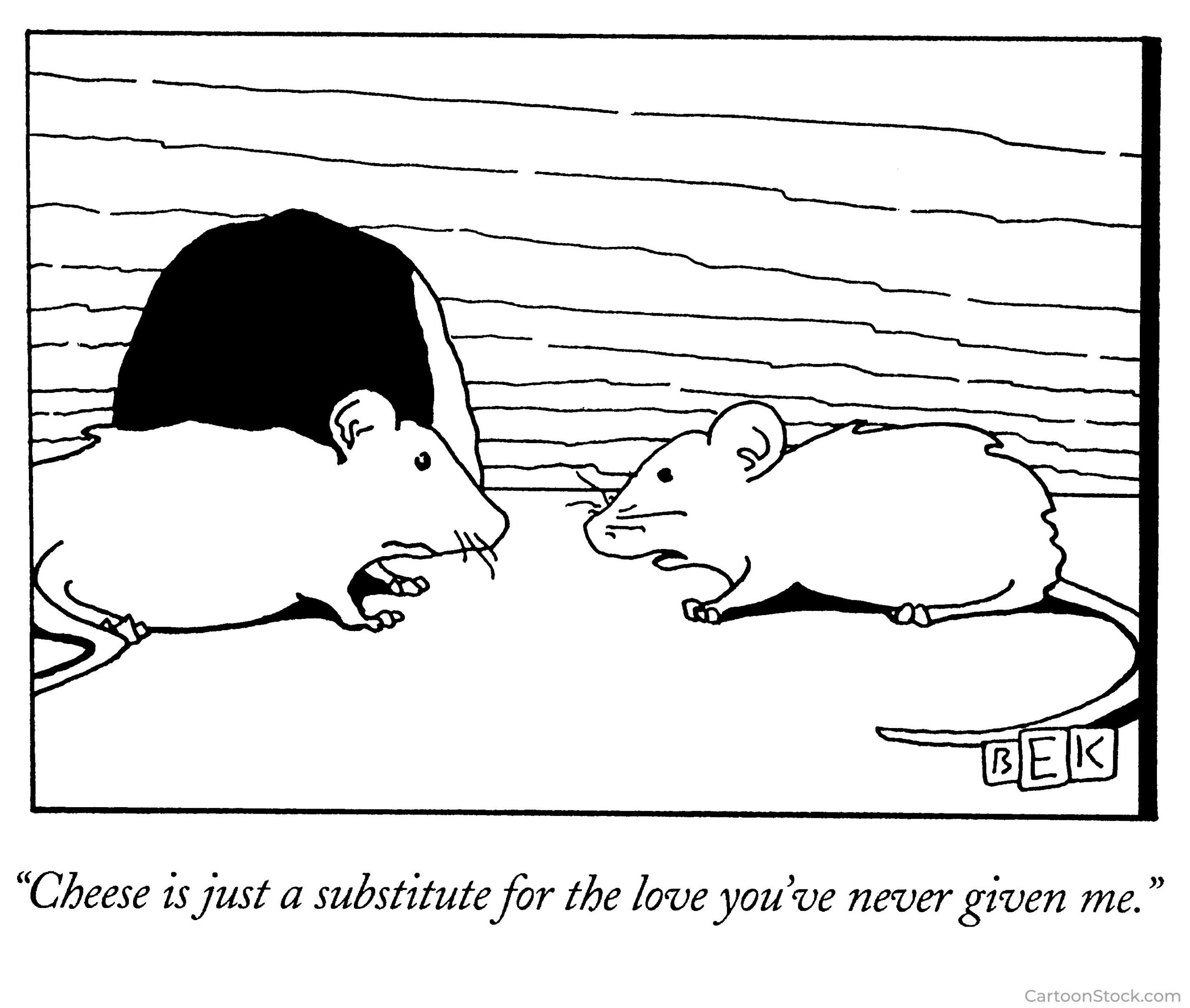

After a life spent outrunning change, outwitting cats, and out-earning half of Mayfair, Ignacious the Mouse did what any self-respecting, semi-retired financial genius does when bored stiff by his third Port-and-cracker lunch. He became a Financial Adviser. Not just any adviser, mind you. No, Ignacious styled himself “Cheese Strategist to the Masses and Guardian of Inheritance Cheddar,” though most of his clients simply called him “that tiny mouse with the alarming monocle.”

It all began in the wake of yet another human-fangled upheaval. Something about pensions, legislation, and the British government doing what it does best: changing the rules just as people were about to understand them. “From April 2027, unused pension funds will be subject to Inheritance Tax.”

“April 2027,” Ignacious declared to clients, pacing atop a walnut. “It’s like they have discovered a vault of forgotten Wensleydale and are now charging rent on it.” The change worried Ignacious. He’d spent years lecturing squirrels on passive income and hedgehogs on hedge funds. So, he took up his hat, dusted off his chalkboard, and opened the first rodent-run financial advisory firm: Mature Vermin Asset Management, or MVAM for short.

Change always means work. MVAM was besieged, not panicked, but twitchy. Clients didn’t just want calculations anymore. They came for comfort. They came to ask whether their quiet little nest egg in the corner had become a ticking dairy bomb. And they came for more than numbers. Because Ignacious had grown older, wiser, and only slightly more cynical. He no longer peddled cold efficiency. He no longer worshipped untouched wealth as the peak of planning. No. Now, he preached something softer. Something braver. Gone were the halcyon days of “touch your pension last and live off biscuits.” He began preaching a new gospel: Use the cheese while it matters. After all, from April 2027, letting your retirement pot sit untouched until death would mean leaving your children not a legacy, but a moderately insulting tax bill.

So Ignacious found himself saying: Not just, “Preserve wealth.” But “Spend it where it matters, while it matters.” Not just, “Be efficient.” But “Be generous, if you can.” Not just “Plan your estate,” but “Choose your impact.”

After all, pensions don’t raise grandchildren. Hoarded cheddar doesn’t visit you when you are lonely or phone you on a Wednesday. And legacies aren’t just written in wills. They are written in birthday presents you could afford to give. In grandchildren you helped through university. In the local hedgehog hospital, you believed in enough to fund while you were here to see the difference. This change, Ignacious assured them, wouldn’t kill anyone. But it might save someone, in the quietest of ways. From struggle. From silence. From scarcity. So yes, April 2027 is coming. But maybe it isn’t the threat first perceived. Maybe it’s an invitation. An invitation to act now. To plan smarter. To give braver. After all, the best legacy isn’t what we leave. It’s what we give, while we’re still here. Still loving. Still able.

And if his friends needed help to plan, Ignacious would be there. Probably holding the tea, the biscuits, a tax guide, a little bit of cheese and some tissues. Just in case.